One vital component of the planning involved in divesting any commercial real estate asset should account for the ability to prospectively defer Federal and State capital gains taxes and depreciation recapture income tax liabilities associated with said divestiture through the election and completion of a 1031 Exchange. Over a myriad of 1031 transactions resulting in hundreds of millions of dollars worth of successful exchanges, Cambridge Capital Advisors has demonstrated tremendous expertise in advising and assisting its clients with the complexities associated with this process.

At Cambridge Capital Advisors, we understand the highly critical nature of the chronology of the transaction and its patent and latent pitfalls and exposures. In addition, we possess the ability to identify and source assets that not only are compatible with our client’s investment objectives but also satisfy the equity and debt components of the exchange. In doing so, we enhance our client’s ability to preserve their capital resources, increase their purchasing power and maximize the tax advantages afforded to them under section 1031 of the United States Internal Revenue Code.

Please feel free to click on the link in the event you would like more specific information regarding 1031 Exchanges, the workings of a 1031 Exchange and how Cambridge Capital Advisors might assist you.

1031 Exchanges

Under Section 1031 of the United States Internal Revenue Code (26 U.S.C. § 1031), the exchange of certain types of property may defer the recognition of capital gains or losses due upon sale, and hence defer any Federal and State capital gains taxes and depreciation recapture income tax liabilities otherwise due. To qualify for Section 1031 of the Internal Revenue Code, the properties exchanged must be held for productive use in a trade or business or for investment. The properties exchanged must be of "like kind", i.e., of the same nature or character, even if they differ in grade or quality. Real properties generally are of like kind, regardless of whether the properties are improved or unimproved. Generally, "like kind" in terms of real estate, means any property that is classified real estate in any of the 50 US states, and in some cases, the US Virgin Islands. For real property exchanges under Section 1031, any property that is considered "real property" under the law of the state where the property is located will be considered "like-kind" so long as both the old and the new property are held by the owner for investment, or for active use in a trade or business, or for the production of income.

Under Section 1031, the sale of the (“relinquished property”) and the acquisition of the (“replacement property”) do not have to be simultaneous. A non-simultaneous exchange is sometimes called a Starker Tax Deferred Exchange. For a non-simultaneous exchange, the taxpayer must use a Qualified Intermediary, follow guidelines of the Internal Revenue Service, and use the proceeds of the sale to buy more qualifying, like-kind, investment or business property. The replacement property must be “identified” within 45 days after the sale of the old property and the acquisition of the replacement property must be completed within 180 days of the sale of the old property.

Restrictions are imposed on the number of properties which can be identified as potential Replacement Properties. More than one potential replacement property can be identified as long as one of the following rules is satisfied:

· The Three-Property Rule - Up to three properties regardless of their market values. All identified properties are not required to be purchased to satisfy the exchange; only the amount needed to satisfy the value requirement.

· The 200% Rule - Any number of properties as long as the aggregate fair market value of all replacement properties does not exceed 200% of the aggregate Fair Market Value (FMV) of all of the relinquished properties as of the initial transfer date. All identified properties are not required to be purchased to satisfy the exchange; only the amount needed to satisfy the value requirement.

· The 95% Rule - Any number of replacement properties if the fair market value of the properties actually received by the end of the exchange period is at least 95% of the aggregate FMV of all the potential replacement properties identified. In other words, 95% (or all) of the properties identified must be purchased or the entire exchange is invalid.

In order to obtain full benefit, the replacement property must be of equal or greater value, and all of the proceeds from the relinquished property must be used to acquire the replacement property. The taxpayer cannot receive the proceeds of the sale of the old property; doing so will disqualify the exchange for the portion of the sale proceeds that the taxpayer received. For this reason, exchanges (particularly non-simultaneous changes) are typically structured so that the taxpayer's interest in the relinquished property is assigned to a Qualified Intermediary prior to the close of the sale. In this way, the taxpayer does not have access to or control over the funds when the sale of the old property closes.

At the close of the relinquished property sale, the proceeds are sent by the closing agent (typically a title company, escrow company, or closing attorney) to the Qualified Intermediary, who holds the funds until such time as the transaction for the acquisition of the replacement property is ready to close. Then the proceeds from the sale of the relinquished property are deposited by the Qualified Intermediary to purchase the replacement property. After the acquisition of the replacement property closes, the Qualifying Intermediary delivers the property to the taxpayer, all without the taxpayer ever having "constructive receipt" of the funds.

The prevailing idea behind the 1031 Exchange is that since the taxpayer is merely exchanging one property for another “like kind” property(ies), there is nothing received by the taxpayer that can be used to pay taxes. In addition, the taxpayer has a continuity of investment by replacing the old property. All gain is still locked up in the exchanged property and so no gain or loss is "recognized" or claimed for income tax purposes. Furthermore, Section 1031(d) defines the basis calculation for property acquired during a like-kind exchange. It states that the basis of the new property is the same as the basis of the property given up, minus any money received by the taxpayer, plus any gain (or minus any loss) recognized on the transaction.

Taking into consideration the complexities any real estate owner/investor encounters when attempting to effectuate a 1031 exchange, having an ability to leverage the capabilities of a firm with demonstrated experience in successfully completing a myriad of 1031 transactions is critical. Based on extensive experience, Cambridge Capital Advisors appreciates and understands its client’s risks, tax implications and exposures while undertaking a 1031 exchange. Cambridge Capital Advisors, while working closely with your tax advisor and qualified intermediary, will be an invaluable resource to you not only in identifying the right buyer for your property but also in sourcing the appropriate replacement property(ies) to successfully satisfy your 1031 exchange.

FAQ's About 1031 Exchanges

Featured Property

Spring Lake Town Centre

624 Lillington Highway

Spring Lake, NC

$1,400,000

Cap Rate: 8.00%

Sold

Upcoming Events

Join Cambridge Capital Advisors at the Las Vegas Convention Center for the 2018 ICSC Global Real Estate Convention.

CCA In The News

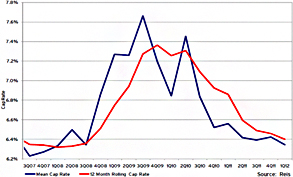

CAP Rate Trends